Invitation to all members

DNK Annual Meeting 2025

| Date | May 26th, 2025 |

|---|---|

| Time | 12:30 (CEST) |

| Location | Rådhusgata 25, 0158 Oslo |

The Board of Directors of The Norwegian Shipowners' Mutual War Risks Insurance Association (Den Norske Krigsforsikring for Skib Gjensidig forening, "DNK") will propose to the General Meeting, scheduled for May 26, 2025, to make a dividend of USD 22.5 million for the fiscal year 2024. The dividend will be made in accordance with the Articles of Association section 3.3:

§ 3-3 Distribution of surplus for the financial yearIf the total premiums and other income of the Association are found to exceed the costs and liabilities for the accounting period, the general meeting may, pursuant to a proposal from the board of directors and to the extent to which this is permitted pursuant to law or regulations, resolve that the surplus, wholly or in part, shall be distributed to members of the Association at the time the resolution was passed, pro rata, based on audited premiums paid by such members during the past 10 operating years. The premiums paid includes the annual premium, premiums for newbuildings, and additional premiums for conditional trading areas for war risk insurance, as well as SIR-premiums. The Annual General Meeting cannot resolve to distribute to the members an amount of the surplus from the accounting period in excess of what has been proposed by the board of directors.

The distribution will be considered a dividend for Norwegian tax purposes, and no withholding tax applies. For members that are limited liability companies, public limited liability companies and certain other entities, 3% of the amount received will be considered taxable income. It is the responsibility of each member to report this income, which is taxed at a general rate of 22 %. The effective tax rate on the received amount is therefore 0.66% (3% x 22%).

Members that are not tax-resident in Norway are as a starting point subject to 25% withholding tax. DNK is therefore required to withhold 25% of the dividend to such members as payable taxes. However, the member can be fully or partially exempt from Norwegian withholding tax if certain conditions are fulfilled:

Under Norwegian law, DNK is not allowed to apply a reduced withholding tax rate unless the member has provided DNK with the necessary documentation as required by the Norwegian Tax Payment Regulation section 5-10a (Norwegian: "Skattebetalingsforskriften"). The process is described in further detail below. The process to obtain the necessary approvals from the Norwegian tax authorities can be initiated here. The documentation required is the following:

If a member is entitled to a reduced rate or exemption from Norwegian withholding tax does not submit the required documentation, DNK will be obligated to withhold 25% of the amount to be distributed to that member.

If a member has been subject to a higher withholding tax than it is entitled to, the member can claim a refund of any excess withholding tax from the Norwegian tax authorities. The claim must be submitted together with the above documentation within 5 years from the end of the year the dividend was made. Information on the application process can be found here.

The General Meeting is scheduled to be held on May 26, 2025. Subject to approval by the General Meeting, DNK will make dividend payment to eligible members. Members that are not tax-resident in Norway, and entitled to a reduced withholding tax rate, need to complete the required withholding tax documentation before dividend payments can be made.

To avoid undue delay, or excessive withholding tax, DNK look forward to receiving the relevant documentation from non-resident members that are subject to a lower withholding tax than 25 % by September 30, 2025.

Please note that DNK has not been able to consider non-Norwegian tax issues related to the dividend. All members who may be subject to non-Norwegian taxation are advised to contact their own local tax advisors in order to ensure correct reporting and tax treatment of dividends received from DNK.

All documentation must be uploaded to your organisation(s) profile.

DNK requires you to complete your organisation profile, including payment information and contact persons in order for us ensure timely payout of your dividend.

Your company profile is ready to submit.

You have successfully completed your profile and we will verify it internally. If we have any questions we will contact you.

Your profile is verified

[no name yet]

Must be a person employed in the policy holder company. Necessary information for Annual General Meeting, dividend, important notices etc.

To ensure the timely payout of your dividend, you need to update and / or confirm the required information below.

This is a mandatory step to process your dividend payment.

If you need assistance, feel free to contact our support team at dnks@warrisk.no

To open this window, click the Edit button next to the Company details section on the organisation page.

| Amount (USD) | Withheld tax rate | Withheld tax (USD) | Amount paid (USD) | Bank account | Payment date | Payment group | Withheld tax (NOK) | Exchange rate (USD to NOK) | Dividend Year | Delete | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| No dividends registered | |||||||||||

| IMO | MMSI | Type | |||

|---|---|---|---|---|---|

| Flag | Class |

| Name | Company Number | Relation | Actions | Requested Change |

|---|---|---|---|---|

| Name | Company Number | Relation | Requested Change |

|---|---|---|---|

| Hull & Machinery | |

|---|---|

| Hull Interest | |

| Freight Interest | |

| Total Value |

| Policy Interest | H&M war policy P&I for cruise SIR |

|---|---|

| Policy Number | |

| Expiry | |

| Inception |

| IMO | MMSI | Type | |||

|---|---|---|---|---|---|

| Flag | Class | Raptor |

We'll take care of the update request as soon as you submit it.

You will be notified by email when it gets processed and/or assigned.

You can follow your update request status below.

| Current Value | New Value | Action | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

|

|

|||||

coinsured |

Remove '' as

from the policy

Add and Register

''

(

|

||||||||||

Last Update:

Updated by:

Created:

[no name yet]

| Effective from | |

| Organisation |

| IMO | |

| Name | |

| Flag | |

| MMSI | |

| Class | |

| Type |

| Currency | |

| Hull & Machinery | |

| Hull Interest | |

| Freight Interest |

| Company Name | Relation | Address | Email/Contact | |

|---|---|---|---|---|

| Date | May 26th, 2025 |

|---|---|

| Time | 12:30 (CEST) |

| Location | Rådhusgata 25, 0158 Oslo |

DNK requires you to complete your organisation profile, including payment information and contact persons in order for us to process your annual dividend payment.

We are currently observing significant GNSS interference in regions including Russia, Ukraine, and Arabian/Persian Gulf. This may result in inaccurate vessel location data, causing incorrect breach reports.

Our team is actively working to improve detection and handling of these anomalies. If you receive a trip notification with incorrect tracking from these areas, please note that we are already monitoring and addressing the issue.

For more information on GNSS interference, please see Norma Cyber Annual Threat Assessment 2025.

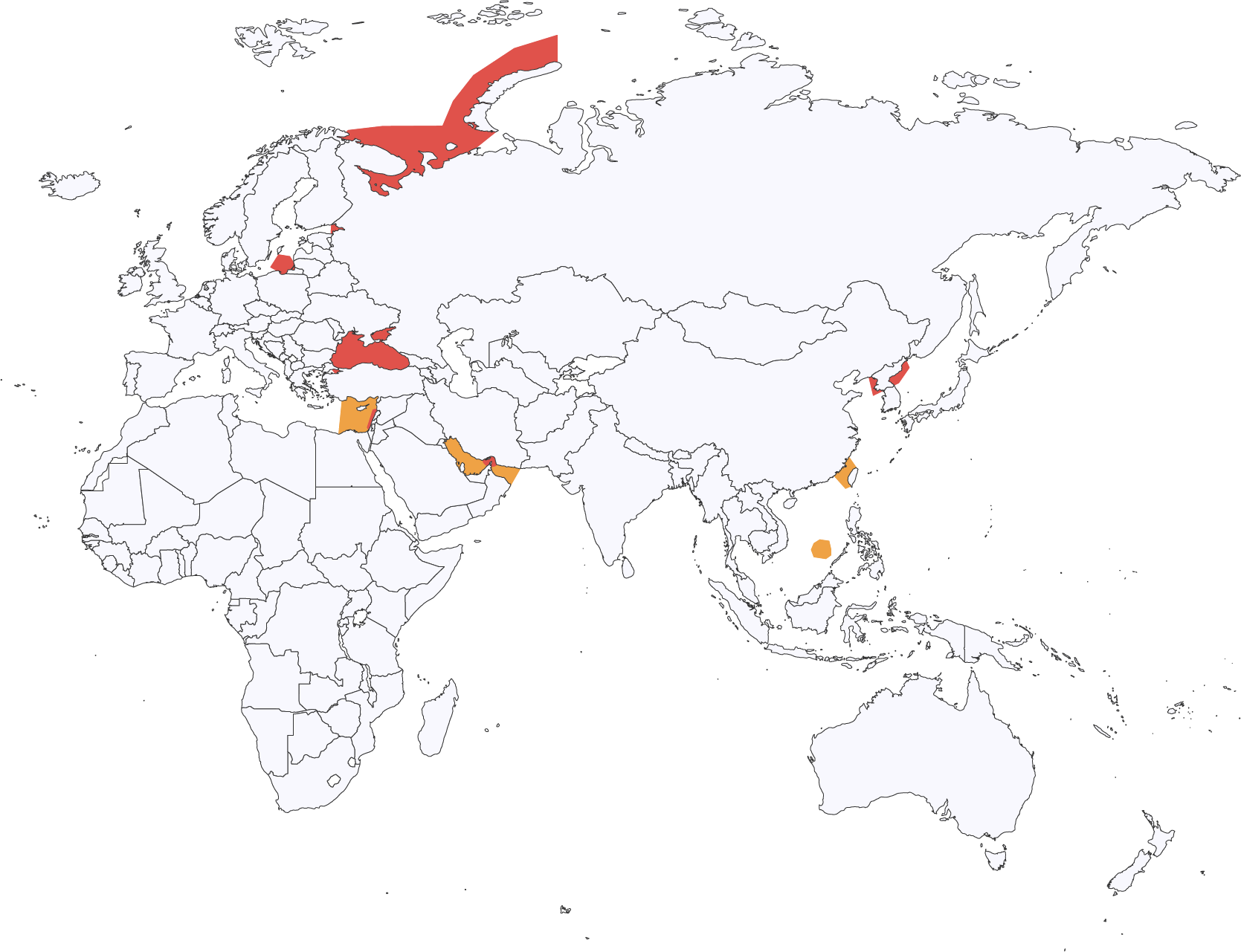

Norway is legally obligated under international law to implement sanctions adopted by the UN Security Council. In addition, Norway enforces a range of restrictive measures adopted by the EU. The map below is limited to sanctions implemented by Norway.

Please note other sanctions, primary or secondary, prohibition or restriction under United Nations resolutions, or the trade or economic sanctions, laws or regulations of the European Union, the United Kingdom, the United States of America or any State where the insurer or its reinsurers have their registered office or permanent place of business may apply. Ref. NMIP 2-17 and DNK’s insurance conditions Clause 4.

In addition to presenting Threat Areas on the DNK map, which are geographical distributions of the different Threat Levels towards vessels forecasted for future transits, you may now also access Incident Reports on the DNK map. The Incident Reports are provided by Risk Intelligence and are accurate and credible descriptions of relevant historical or ongoing security events at sea.

This service is supplemented by implementing a full 24-7-365 monitoring service of the DNK insured fleet, with capability to produce a tailored and contextualized DNK Warning to any DNK insured vessel at imminent risk at any time – anywhere.

For any inquiries related to the transition to the new system or assistance with its usage, please reach out to dnks@warrisk.no

- Your DNK Team

Cover for cyber risks on ships and ashore available from 1st April.

Loading...

Complement your cyber protection under the war policy with an additional Cyber Cover that includes loss prevention, incident response and financial loss coverage from cyber risks for the entire fleet and onshore operations, under the same insurance policy.

The new DNK Cyber Cover is an optional, additional cover for DNK members that includes loss prevention, incident response and financial loss coverage for the entire fleet and onshore operations against a broad range of cyber events, under the same policy. It will be available to DNK members who complete a technical pre-qualification and vulnerability assessment carried out at DNK's expense.

Get contacted about DNK Cyber Cover| Organisation | Created | Created by | Updated | Updated by | |

|---|---|---|---|---|---|

|

|

| Organisation | Created | Created by | Updated | Updated by | |

|---|---|---|---|---|---|

|

|

| Organisation | Created | Created by | Updated | Updated by | Inception | Expiry | Status | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Addendum |

|

|||||||||||

| Organisation | Created | Updated | ||

|---|---|---|---|---|

| Organisation | Created | Created by | Updated | Updated by | Inception | Expiry | Status | |

|---|---|---|---|---|---|---|---|---|

|

|

Your IP-addresses and domains will be forwarded to NORMA Cyber after confirming your consent with DNK underwriting team.

NORMA will use this data to perform an external scan.

From NORMA:

We utilise a third-party External Attack Surface Management (EASM) solution in conjunction with databases containing information about domains, subdomains, and IP addresses.

This solution automatically identifies exposures, vulnerabilities, and misconfigurations related to assets connected to the customer.

The process begins with domains and IPs provided by the company, as well as data from open sources.

A digital footprint is created by indexing the internet and discovering known and unknown internet-facing assets based on these inputs.

These are considered external assets because they are identified through external internet scans.

What is visible in these scans represents what any potential threat actor sees when probing an organisation’s external attack surface.

External assets can be located centrally or remotely across different environments, subsidiaries, cloud providers, and third-party vendors.

The scan must be considered a snapshot and securing the assets requires continuous effort from the owner, as IPs and domains may change over time.

The scanning process is non-intrusive and does not attempt to verify vulnerabilities or perform active actions on the assets.

It is not a penetration test, but a vulnerability scan. Such scans provide an understanding of the information available regarding external infrastructure.

Key Service Providers - KSPs

Business criticality

When mapping your KSPs, there is one paramount element to consider: Business Criticality. How much would your business operations be impacted by a cyber-attack on the supplier in question. Consider that cyber-attacks usually are resolved within a few days. If your business operations are severely impacted by the downtime at this supplier, you should consider it a KSP.

Typical KSPs

Managed Service Providers (MSPs) - Intility, ATEA, Move, iTeam, Amesto, Itera etc.

Software as a Service (SaaS) – Gsuite, AWS, Azure, Salesforce, Accounting software etc.

Firewall solution provider – Sonicwalls, Fortinet, NordLayer, Cisco, VMWare, Barracuda etc.

Virtual solution providers – V2 Cloud, Citrix, Oracle etc.

*Many of the companies listed above provide services under multiple of the categories, even though they have not been listed multiple times.

| Company | Type | Share | Premium |

|---|

| Enterprise | Premium | |

|---|---|---|

| Annual turnover (USD) | ||

| Premium | ||

| Marine | Premium | |

| Fleet count | ||

| Total fleet insured value | ||

| Premium | ||

| Loss of hire | Premium | |

| Average day rate | ||

| % of limit | ||

| FLS | ||

| Premium | ||

| Total | Premium | |

| Sum |

| No. | Policy draftPolicy | QuoteInvoice | Created by | Creation date | Inception | Expiry | Status | Action |

|---|---|---|---|---|---|---|---|---|

|

|

|

_by | _status | |||||

| Empty | ||||||||

[N/A]

Are you sure you want to delete this?

Are you sure you want to delete this file?

Sensitivity:NB: The deletion of the file will be logged.

| Date | Event | User | File |

|---|---|---|---|

|

|

| Filename | Sensitivity | Download | Delete |

|---|